How to calculate cost basis crypto

What Is Cryptocurrency?

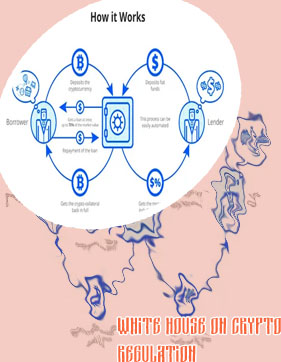

And by and large, the crypto order set off a positive reaction from the banking corners of Washington. The Bank Policy Institute lauded the “clarity” more federal action of crypto would bring, and applauded the idea of bringing crypto and fintech startups into a regulatory scheme. The trade group noted that “regulated financial institutions have been stuck on the sidelines waiting for further regulatory action before expanding their digital offerings.” Says all cryptocurrencyrelated transactions are must A crypto tax calculator is a computer software program that allows crypto users to manage and file their crypto taxes. Usually, it comes with a complete crypto portfolio tracker, which allows users to view all their crypto assets, trading, and other activities across different crypto exchanges and wallets under one centralized interface.

How to determine cost basis of cryptocurrency

Flexible, customizable, and automated. Intelligently invest your way, commission-free.

In Minnesota, NFTs are subject to sales and use tax when the underlying product (goods or services) is taxable in Minnesota. NFTs may entitle purchasers to receive products or services including but not limited to: CNBC Anchor Alleged NBCUniversal Boss Jeff Shell Sexually Harassed Her, Prompting His Exit Individual units of cryptocurrencies can be referred to as coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods and services, others are stores of value, and some can be used to participate in specific software programs such as games and financial products.